Digital Financial Stack that support convergence of financial services

Businesses are modernizing their operations to support convergence of online and offline commerce. With the acceleration of technology adoption, smartphones and mobile devices revolves around the consumers and it plays an important role in their life. However, due to the legacy system of financial institutions, it is not nimble enough to quickly provide needed solutions for modern businesses to upscale.

Digital Payment Hub

Soft Space’s Digital Payment Hub aims to provide financial institutions with the essential tools to incorporate various core financial services for their customers.

The Digital Payment Hub is designed to be secure and modular. It incorporates secure open application program interfaces (APIs) to enable third parties to develop value-added features that can be easily integrated with any of the financial institution’s platforms. By designing it to be modular, financial institutions can pick and choose the different modules to suit their business needs.

Our solutions consist of several payment acceptance methods that can meet the ever-changing payment needs of businesses.

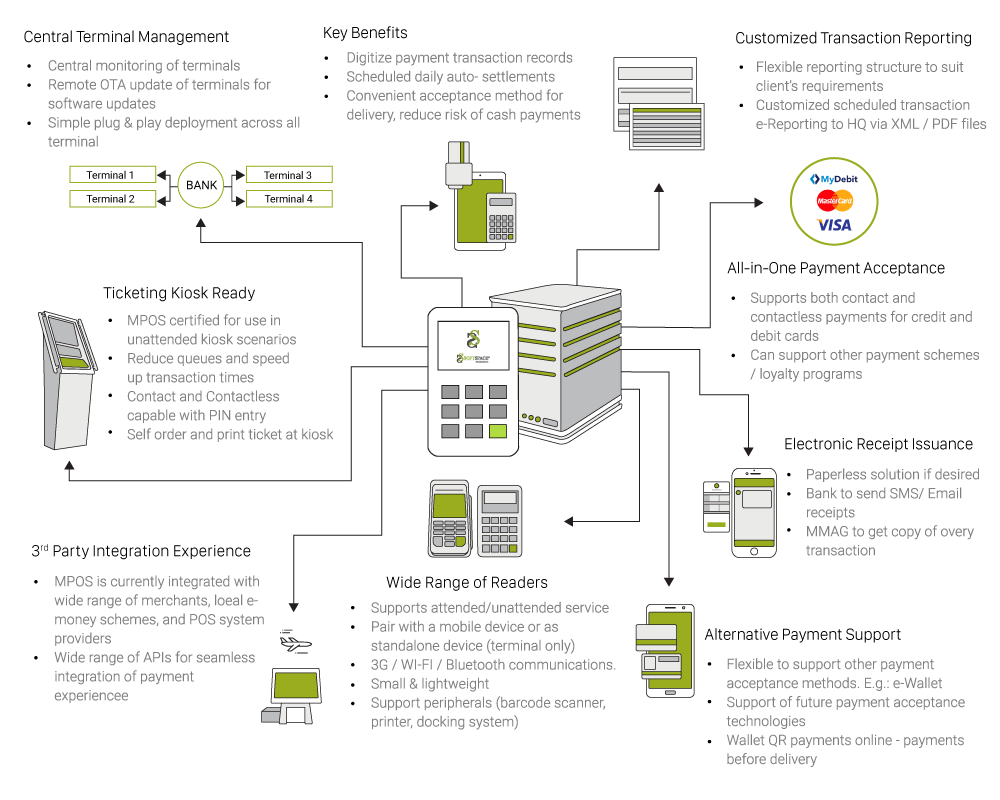

mPOS & Lighthouse

Technological advances are made every single day and it’s integrating into our daily lives. Soft Space products provide a holistic approach that would elevate the banking and payment industry to a whole new level.

E-wallet

Soft Space introduces an e-wallet solution to assist the transition from cash-based

to cashless e-payment systems.

Our E-Wallet system supports both QR code and Bluetooth devices to enable users a better and safer payment method. This gives an opportunity to strengthen customer relationships by offering a more convenient shopping experience. Customers can enjoy exclusive promotions from participating outlets nationwide.

For more information, please visit https://fasspay.com/

QR code payments

The use of QR codes is steadily increasing in many businesses today as it provides a versatile and practical way to encourage e-payment adoption. Soft Space utilizes Static and Dynamic QR code technologies to introduce next level security and convenience without any performance degradation. Our solution complies with the EMVCo standards to enable merchants to accept QR code payments from various providers in a standardized manner. Consumers will also benefit from a more uniform experience that offers greater convenience and familiarity.

Terminal Management System (TMS)

Soft Space offers an innovative solution to digitalize banking processes that can capture and store customer’s transactions from the current Electronic Data Capture (EDC) services. With this primary objective, Soft Space provides a platform with terminal management and reporting capabilities that can benefit your business.

These are some of the services we offer:

Terminal Management Console

- Terminal Management Portal

- Merchant Portal

- View and store transaction details

- Open support for various signature pad hardware

- Remote key injection

- OTA software/OS update

- Remote diagnostics

- Auto initiate fail over

Content Management Module

- Create and push text and image content

- Content management functions

- Role based/maker checker function

Reporting Module

- Access and extract aggregated data

- Configurable report by sales, transaction count, ticket size, monthly sales and year-to-date sales

- Configurable sales report to show the capability of sales report by store, by terminal, by HQ and by settlement batch

- Terminal inventory and profitability report

- Audit Trail

- Alert Generation

VAS Module

- Designed to cater for Mobile Payment/e-Wallet for both open and closed loop

- Support payment by bank loyalty points, third party loyalty points, partial credit and loyalty points payment

- BIN routing for on-us, off us payments

Web Management Console

Built with Data in Mind

At the core, the Digital Payment Hub is built with data in mind.

Machine Learning

Data collected by the payment solutions modules can allow financial institutions to introduce new services for their customers. They can also choose to use the data engine within the payment hub or utilize Soft Space partners approved services for data insights.

With the introduction of Machine Learning, business insights from payment data collected can process huge amount of information to offer several value-added features that can achieve customer satisfaction.

We believe that data intelligence offers a distinct advantage against their competitors to be used for fraud management, data analytics and various business case.

Intelligent Customer Relationship Management (CRM)

Soft Space and transcosmos inc. partnership introduces an omnichannel customer relationship management (CRM) solution that helps enhance financial institutions’ digital engagements to a whole new level. Our partnership with transcosmos inc. enables merchants to deliver appealing ads and loyalty marketing programme that can directly send tailored discount coupons to customers’ smartphones that leverages both offline and online data.

Money Lending Services

The data and business insights collected from utilizing Soft Space’s Digital Payment Hub can offer on demand loan services for merchants, with a fast and easy application approval to provide seamless lending experience. Now everyone can loan money.

Our credibility and platform security

We deal with payments and transactions every day, hence security, risk management and data protection require high level of security and regulatory compliance – we want to build a foundation of trust with our clients.

The world’s perception of payments has been changed as we are quickly moving towards a world where seamless payments work seamlessly, anywhere at any time. To us, it has always been about our customers and how we can enhance their consumer experience without jeopardizing on security.

Our platforms and products adhere to the highest level of global security standards. Our solutions have been through numerous penetration test, strict scrutiny compliance and meticulous procedure before being adopted by financial institutions all over Asia.

PCI Data Security Standards

Soft Space is PCI Data Security Standards (DSS) compliant which is to help protect the safety of data. They set the operational and technical requirements for organizations accepting or processing payment transactions, and for software developers and manufacturers of applications and devices used in those transactions.

All the sensitive Credit Card Data is processed in the bank’s PCI certified data center and our Point-to-point encryption (P2PE) solution secures acceptance point (card reader, mobile application and e-wallet) to the credit card host.

Soft Space starts from payments, we adopt the same strict blue-chip security excellence to instill user confidence in our products and services. Our technologies are encrypted with complex cryptography to reduce the risk of fraud and financial crimes. We are committed to protecting sensitive original data information from any malicious threats and strive to ensure secure payment processes.

Visa Ready Program

A certification that meets Visa Inc. requirements for a reliable, convenient, and secure mobile point of sale experience.

Mastercard Mobile POS Self-certified Solution Providers

A recognition as best in class assessed against MasterCard Mobile POS Best Practices to promote simple and secure transactions

UnionPay International Registered mPOS Solutions

A recognition of security, stability and universality for products linked to the UnionPay brand.