Live Payments Launches LiveTap, Helping Drive Contactless Payment Acceptance in Australia

JCB, IDEMIA and Soft Space launch “JCBDC” pilot to test CBDC in-store payments

October 25, 2022

Taishin Bank Upgrades its Taishin Merchant App to Launch Discover Tap on Mobile Solution, Powered by Soft Space

November 8, 2022

Live Payments Launches LiveTap, Helping Drive Contactless

Payment Acceptance in Australia

In partnership with world’s leading fintech player, Soft Space, LiveTap will empower

merchants to harness cutting-edge contactless payment technology

Kuala Lumpur, 3rd October 2022 – Live Payments, one of Australia’s leading payment providers has developed its ‘tap to phone’ contactless payment product LiveTap, and is set to roll out the product to its merchants later this year. The news comes as card payments continue to rise in Australia, with 87% of Australians in 2021 preferring to use cards including digital wallets, compared to only 7% who choose to pay with cash.

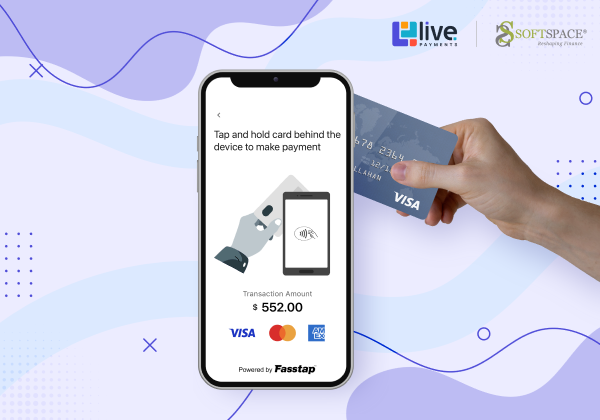

Powered by fintech-as-a-service provider, Soft Space, LiveTap allows customers to simply tap their smartphone, wearable or physical card on a merchant’s Android NFC-enabled mobile device to accept contactless card payments. LiveTap will help drive down the ‘payment acceptance’ obstacles merchants face, and will enable customers to have a seamless experience for both in-store and mobile payments.

Reuven Barukh, CEO at Live Payments commented: “The payments landscape is becoming increasingly fragmented. It’s now all about managing multiple payment methods, having simple and convenient options, and adapting to customers’ needs – our LiveTap solution addresses this directly.”

Live Payments has harnessed the mobile card acceptance technology of its app to app payment partner, Soft Space, allowing its secure APIs to be integrated with Live Payments’ platforms.

With no additional hardware or device required, LiveTap is an especially exciting option for SMBs and micro businesses that may not have the resources for full point-of-sale infrastructure. SMBs (employing fewer than 20 people) make up 97.5% of businesses in Australia.

“This solution takes full advantage of Australia’s love affair with contactless transactions,” said Joel Tay, Chief Executive Officer of Soft Space.

Reuven Barukh adds, “As more consumers prefer the speed and convenience of a cashless payment option, the rollout of Tap To Phone with our merchants will drive the adoption of this type of technology, helping both consumers and businesses benefit from convenience as well as reducing the risks of cash handling. And all this is achieved without the need for merchants to use a dedicated payment terminal.”